Reports

Copy page

Copy page as Markdown for LLMs

Open in Claude

Ask questions about this page

Amazon Payment Services provides comprehensive reporting and monitoring tools to help you track transaction performance, generate financial reports, and monitor your merchant account in real time. Access detailed insights through our dashboard, generate custom reports, or use our API for automated reporting.

Real-time Monitoring

Monitor transaction flows, success ratios, and performance metrics with automatic dashboard refresh

Financial Reports

Generate detailed financial reports for accounting and reconciliation purposes

Transaction Reports

Access comprehensive transaction data with advanced filtering and status tracking

API Reporting

Integrate reporting capabilities directly into your applications with our reporting API

Real-time Monitoring

Monitor the current status of transaction processing in your merchant account in real time using our monitoring dashboard which refreshes automatically. You can also configure push notifications and transaction alerts.

The monitoring dashboard displays at-a-glance information on transactions per minute, success ratios, and uncertain transactions. You also get instant insight into failed responses and total payment volume.

Accessing the Monitoring Dashboard

Navigate to Dashboard

Login to your back office and click Monitoring Dashboard in the top left navigation bar.

Configure Filters

Specify filters to limit real-time monitoring to specific transaction subsets, or click Search to view all transactions.

Monitor Performance

The dashboard will refresh automatically, delivering continuous updates throughout the day.

Real-time Metrics

Key Performance Indicators

- Transactions per Minute: Real-time processing rate

- Attempt Success Ratio (ASR): Percentage of successful transactions

- Failed Response Codes: Breakdown of failure reasons

- Total Payment Volume: Overall transaction volume for your account

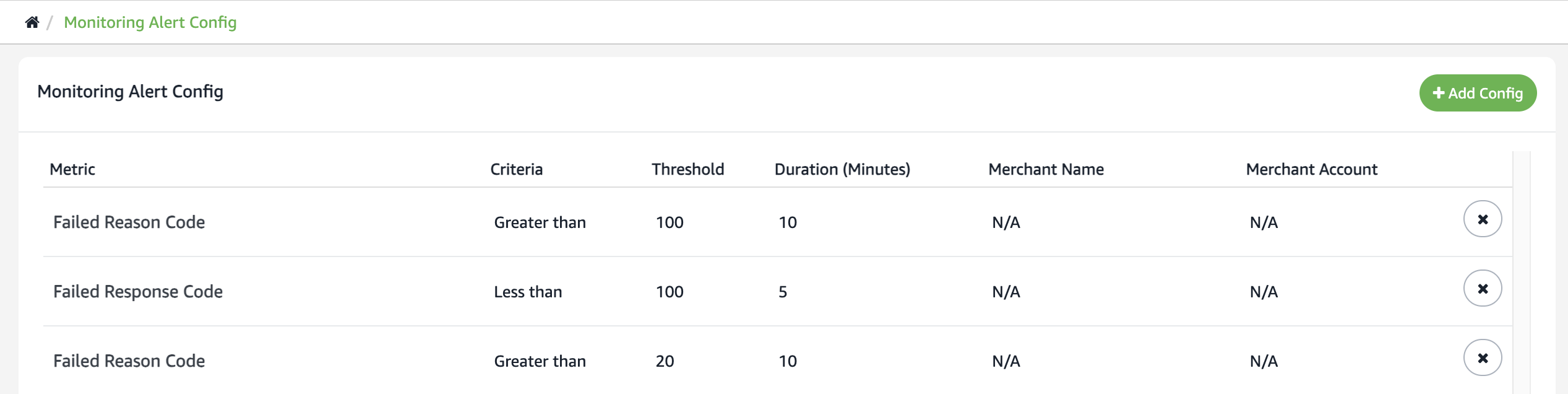

Configure push notifications and transaction alerts to stay informed:

- Transaction Events: Notifications for failed purchases or specific events

- Volume Changes: Alerts for unusual transaction volume patterns

- System Issues: Notifications when processing issues are detected

Transaction Dashboard

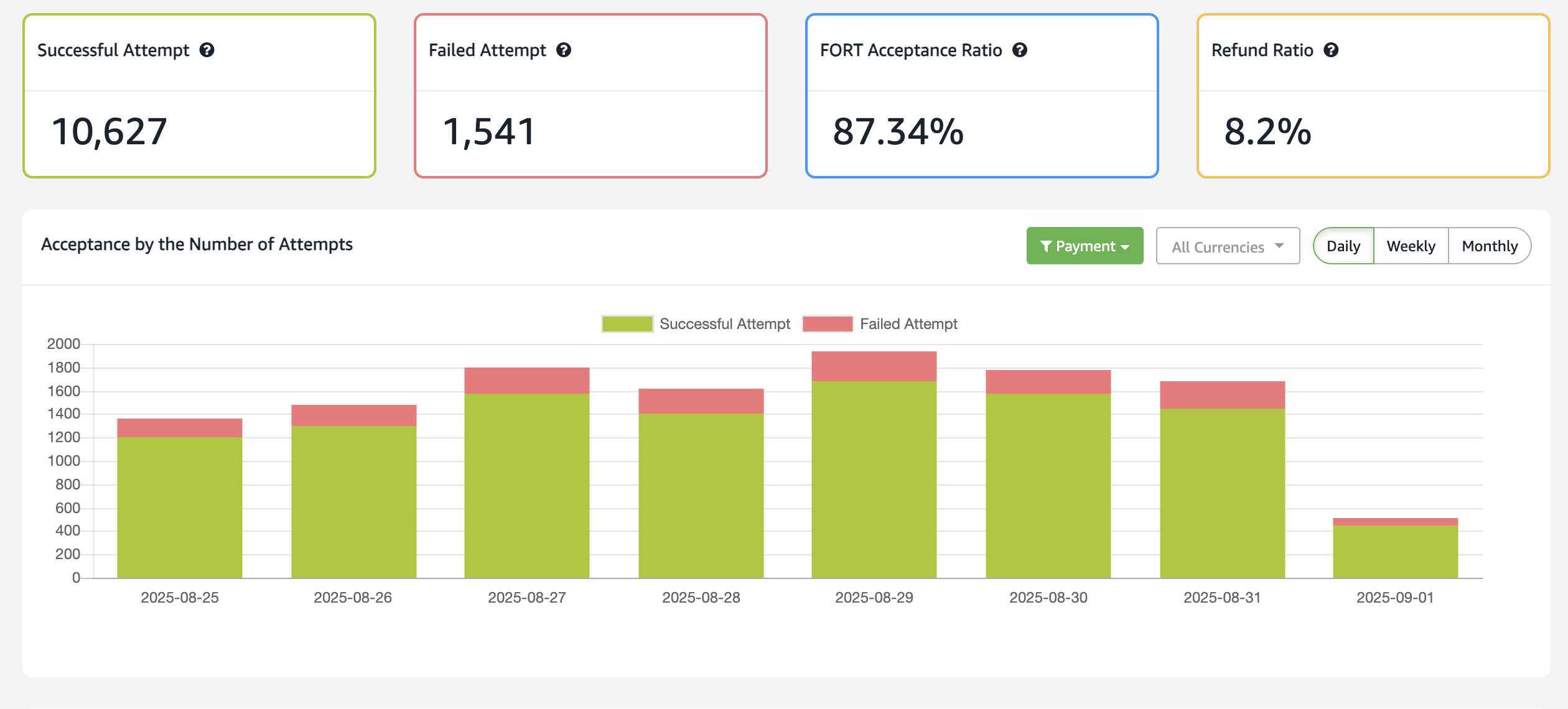

The Amazon Payment Services dashboard helps you monitor the performance of your merchant account, including an instant overview of transaction volume, acceptance rates, and the most common reasons for declines.

Using the transaction dashboard, you get an instant overview of your transaction performance at a single glance with key insights including:

- Successful Transactions: Count of successful captures and purchases (authorized amounts don't count)

- Failed Transactions: Failed authorizations, purchases, and incomplete transactions

- Acceptance Ratio: Ratio of successful compared to failed transactions

- Refund Ratio: Percentage of transactions leading to refund requests

Customizing the Transaction Dashboard

Currency Filtering Monitor performance according to specific currencies (USD, AED, etc.)

Time Period Selection

- Daily monitoring for specific day analysis

- Weekly overview for short-term trends

- Monthly reporting for broader performance insights

- Custom date ranges for specific periods

Generating Reports

Use the dashboard reporting tool to monitor merchant account performance and draw insights across specific aspects of your transaction pipeline—from payment method to individual acquirer.

Report Types

- Financial Reports

- Transaction Reports

Supply your finance team with critical data using our Financial Reports tool, accessible under the Reports tab.

Available Filters

- Merchant Reference ID: Search by your unique reference

- Transaction ID: Find specific orders using unique transaction ID

- Date Range: Filter by specific time periods

- Acquirer: Filter by processing bank or financial institution

- Payment Method: Filter by debit card, credit card, or consumer finance

- Payment Option: Filter by payment network (Visa, Mastercard, etc.)

- Currency: Filter by processing currencies

- Operational Data: Filter by operation type (Refund, Authorization, Void, Capture, Purchase)

Get full insight into all transactions using the transaction reporting tool, accessible under Transaction Reports in the Reports tab.

Advanced Filtering All financial report filters plus:

- Transaction Status: Filter by Accepted, Declined, Pending, Uncertain, Dropped, In Review, On Hold, Processing

Report Generation Process

Access Reports

Navigate to the Reports tab in your back office dashboard.

Select Report Type

Choose between Financial Reports or Transaction Reports based on your needs.

Configure Filters

Set your desired filters including date range, currency, payment method, and other criteria.

Generate Report

Click generate to create your customized report with the specified parameters.

API Reporting

Extract highly customized reports using our reporting API. By custom-coding reporting capabilities that directly link to your web application, you can analyze Amazon Payment Services transaction data in great depth.

API Capabilities

Data Volume

- Query limit of 200,000 records per request

- Long transaction history retrieval

- Bulk data extraction capabilities

For complete API reference and implementation examples, visit our API Reference.

Transaction Queries

Merchants frequently need to examine specific transaction details for customer queries or technical troubleshooting.

Access Transaction Reports

Navigate to Transaction Report page under the Reports tab.

Search by Identifier

Search using your unique merchant ID or the unique transaction reference number from Amazon Payment Services.

Review Results

Search results show exactly what happened to the specific transaction—confirming approval, decline, or other status.