Overview

Copy page

Copy page as Markdown for LLMs

Open in Claude

Ask questions about this page

Payment Links offer a flexible payment collection solution that accommodates different business needs and technical capabilities. Whether you prefer a no-code approach through our merchant dashboard or automated control via API integration, Payment Links provide a secure, hosted payment experience without requiring your own website or complex e-commerce setup.

Integration Methods

Payment Links can be implemented in two distinct ways to match your business requirements:

No-Code Dashboard Integration

Perfect for businesses that want to start accepting payments immediately without any technical development:

- Zero coding required - Create and manage payment links entirely through the Amazon Payment Services merchant dashboard

- Manual link creation - Generate payment links on-demand for individual transactions or customers

- Built-in customer notifications - Automatically send payment links via email or SMS directly from our platform

- Instant setup - Start collecting payments within minutes of account activation

API-Based Integration

Designed for businesses that need automated control and automated payment link generation:

- Automated link creation - Generate payment links automatically through API calls

- System integration - Seamlessly integrate with your existing CRM, billing system, or custom applications

- Automated workflows - Create payment links as part of your business processes

Both approaches deliver the same secure, hosted payment experience to your customers while offering the flexibility to choose the integration method that best fits your technical capabilities and business workflow.

How Payment Links Work

The payment process follows these simple steps:

Link Creation

Create a payment link through the merchant dashboard or API with customer details and payment information.

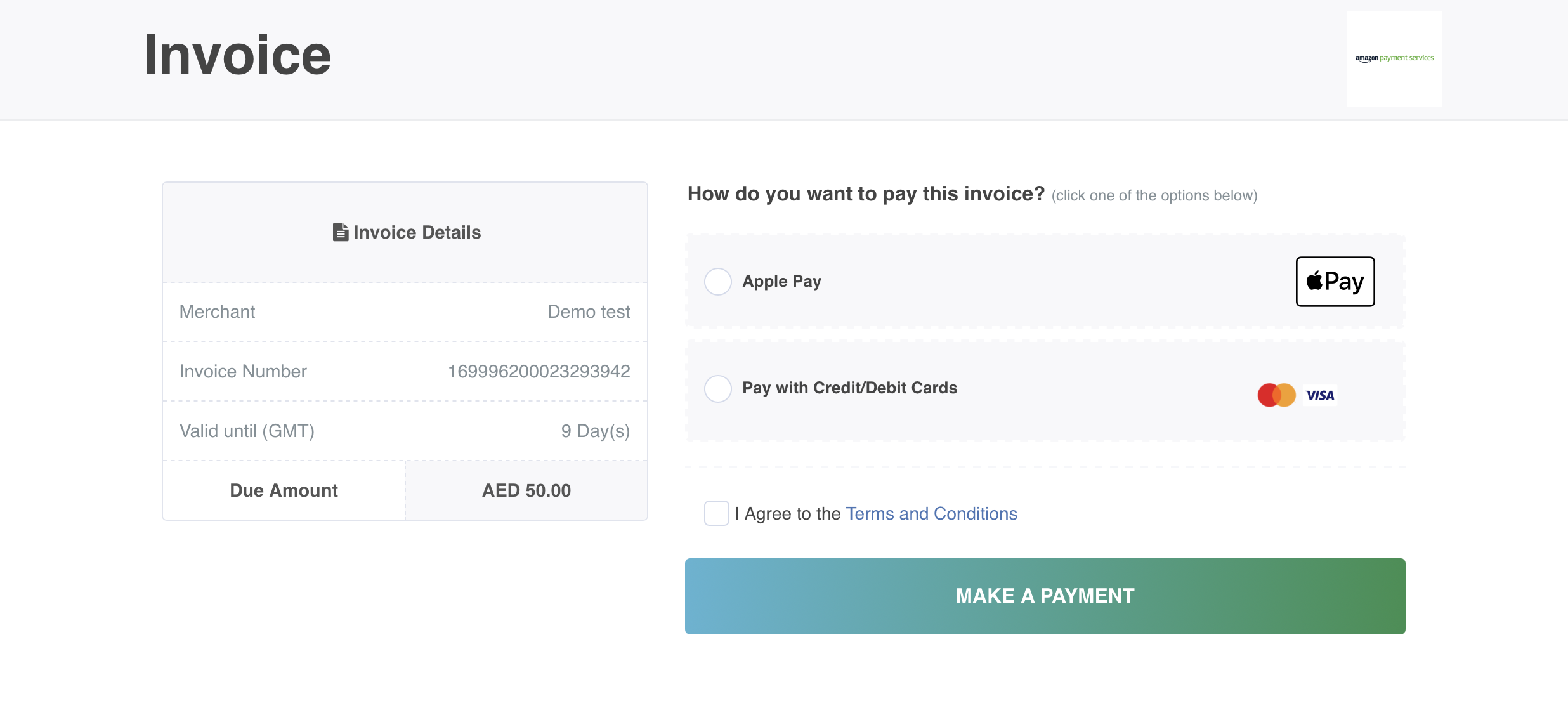

Secure Payment

Customer clicks the link and completes payment on the hosted page using their preferred payment method.

Transaction Completion

Customer receives confirmation and you get instant notifications about the payment status.

Supported Payment Methods

- Cards

- Digital Wallets

- Local Payment Methods

- Buy Now, Pay Later

| Card Type | Supported Regions | Notes |

|---|---|---|

| Visa | Global | All card types supported |

| Mastercard | Global | All card types supported |

| American Express | Global | All card types supported |

| MADA | Saudi Arabia | Local debit card scheme |

| Meeza | Egypt | Local debit card scheme |

| Wallet | Supported Regions | Integration Notes |

|---|---|---|

| Apple Pay | 60+ countries | Available on supported devices |

| Payment Method | Country | Currency | Notes |

|---|---|---|---|

| KNET | Kuwait | KWD | Purchase operations only |

| NAPS | Qatar | QAR | Purchase operations only |

| OmanNet | Oman | OMR | Purchase operations only |

| BENEFIT | Bahrain | BHD | Purchase operations only |

| STC Pay | Saudi Arabia | SAR | Requires phone number validation |

| Provider | Supported Regions | Notes |

|---|---|---|

| Tabby | UAE, Saudi Arabia | Purchase operations only |

Key Features

- No coding required - Generate payment links without technical integration

- Automatic delivery - Amazon Payment Services sends links directly to customers via email or SMS

- Multi-payment options - Support for cards, wallets, and local payment methods

- Save Card feature - Allows customers to securely store their card details for future transactions

- Installment payments - Built-in installment options where available

- Customizable branding - Add your logo and colors to match your brand

- PCI DSS compliant - Secure payment processing without compliance overhead

- 3D Secure authentication - Built-in fraud protection

- Email invoices - Automatic customer receipts and notifications

- Multi-language support - Arabic and English interfaces

- Mobile responsive - Optimized for all device types

- Payment management - Void, capture, or refund directly from dashboard

- Real-time notifications - Instant payment status updates

- Expiration control - Set custom expiry dates for payment links

Who Should Use Payment Links?

Payment Links are ideal for:

- Merchants without online stores - Need to charge customers for services or products without an e-commerce website

- Order-based businesses - Take orders over email, chat, or phone calls and need a simple way to send payment requests

- Small businesses - Quick setup for accepting payments without technical resources

- Invoice-based billing - Businesses that send invoices and need easy payment collection

- Event organizers - Collect payments for tickets, registrations, or services

- Non-profit organizations - Accept donations and payments for causes

- Quick payment requests - One-time or ad-hoc payment collection needs